According to Crisil lower oxygen supplies to temporarily impact five sectors

The demand for medical oxygen is estimated to have rocketed five-fold in the second week of April versus pre-pandemic levels as Covid-19 infections took off

Mumbai (Maharashtra) –

Metal fabrication, automotive components, ship-breaking, paper and engineering sectors are likely to suffer with demand for medical oxygen soaring and the central government barring industrial use, according to global analytics firm Crisil.

The demand for medical oxygen is estimated to have rocketed five-fold in the second week of April versus pre-pandemic levels as Covid-19 infections took off. Crisil said the consequent higher supply of medical oxygen will save lives, but will have a bearing on some sectors.

“The disruption in supply of oxygen for industrial use will temporarily impact revenues of small and mid-sized companies into metal fabrication, automotive components, shipbreaking, paper and engineering,” said Gautam Shahi, Director at Crisil Ratings.

“These typically do not have captive oxygen plants and source their requirement through merchant suppliers for operations like welding, cutting, cleaning and chemical processes.”

Setting up an air-separation plant or importing oxygen requires significant lead time and involves relatively prohibitive cost, so is not a viable option. That leaves them more vulnerable compared with larger peers.

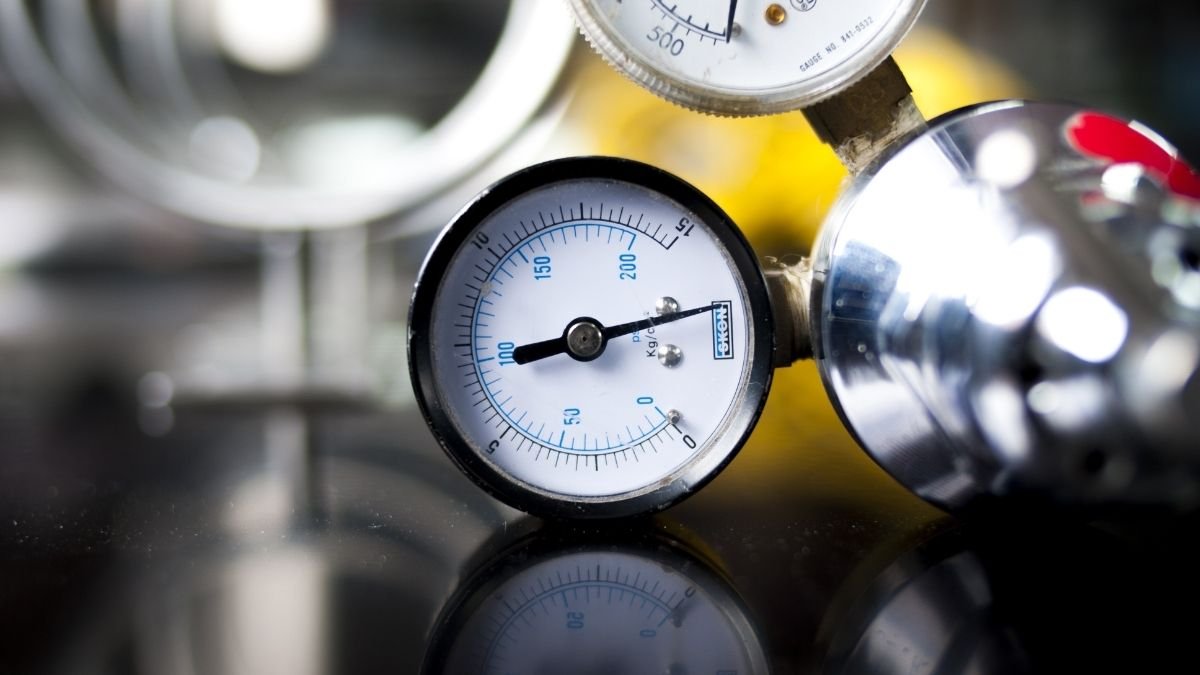

Oxygen is consumed by industry in two ways – onsite, and merchant sales. Onsite is through captive plants for process-driven industries (including the nine sectors exempted by the government) which account for 75 to 80 per cent of oxygen manufactured in India.

The balance 20 to 25 per cent is supplied through merchant sales (called liquid oxygen) through cryogenic tanks and cylinders. The healthcare sector consumes about 10 per cent of merchant sales, and others the rest.

“At this juncture, we believe that the disruption in oxygen supplies for industrial use will be for six to eight weeks,” said Sushant Sarode, Associate Director at Crisil Ratings.

“Besides, affected sectors can partly manage their oxygen requirements with inventory. Therefore we expect only a limited decline in revenue for them. Their credit profiles are expected to be stable.”

However, a prolonged and intense second wave that curtails oxygen supply to industries for a longer period than expected will exacerbate downside risk in affected sectors.

The impact will be greater for companies in Maharashtra, New Delhi, Rajasthan, Madhya Pradesh and Gujarat where medical oxygen demand has increased multiple times due to high Covid-19 case loads.