Stilt Launches Remittance Product for Immigrants

There are over 45 million immigrants in the US who can use Stilt’s remittance product to send money to their families back home.

Stilt, the leading provider of financial services for immigrants, today announced it has added remittance services for its customers. The remittance services will be available for transfer from the US to 46 countries across the world. Stilt will be adding additional countries in the coming months.

Stilt provides a secure, fast, and easy-to-use international money transfer service for immigrants in the US. Customers can transfer funds through the website or the mobile app. It takes just a few clicks or taps to transfer the funds.

It offers the best USD to INR exchange rates — better than Remitly, Transferwise, and Xoom — for transfers from the US to India.

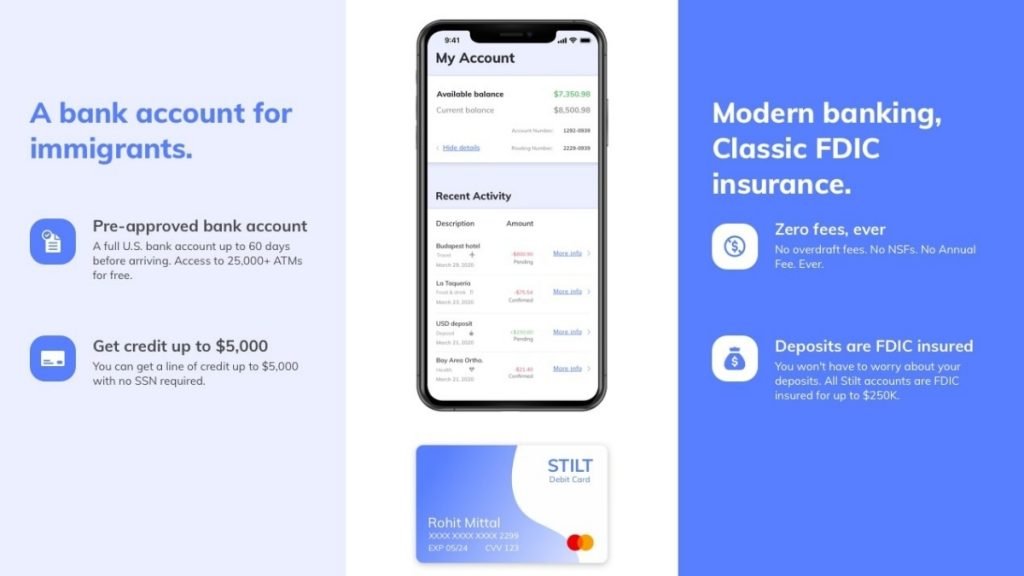

The remittance product is offered through a Stilt checking account specifically designed to save money for immigrants living in the US. Remittance is one of the most common features used by immigrants.

The company was started by two Indian co-founders who met as roommates at Columbia University. Both of them faced challenges with the US credit system. Rohit, Co-founder and CEO, wasn’t able to rent an apartment without a cosigner and had to sleep on a couch for weeks. Priyank, Co-founder and CTO, was the only person who offered a room. All immigrants face similar challenges first hand because they have no identity and limited credit in the US.

Immigrants still have to pay an average of 6.5% fees to transfer funds to their families using older, legacy services. The process takes days and the fees eat into hard-earned money which is meant for the sender’s family. Stilt eliminates those headaches by building technology to lower fees to less than 1% for transfers to India. Indian recipients can receive the funds on average in 3 hours with some banks allowing instant credit.

There are over 45 million immigrants in the US who can use Stilt’s remittance product to send money to their families back home. Stilt also offers loans and other banking services without co-signers, credit history, or collateral, which helps immigrants build credit and a strong financial foundation in the US.

The company has raised over $7.5 million in seed funding from investors including YCombinator and already serves thousands of customers.

For more information, visit www.stilt.com