Minance Founder Anurag Bhatia Speaks About Wealth Management

In conversation with Digpu, Minance Founder And CEO, Anurag Bhatia talks about wealth management, his share of struggles in establishing Minance, how Minance Private Market works for the pre-IPO companies, the effect of the COVID-19 pandemic on the industry as well as the future prospects for the company. Here are excerpts from the conversation –

There are many ideas of wealth management and different people give diverse definitions of it. What is your idea of wealth management? What does a wealth management firm do?

Wealth management can be best called a symphony of advice and execution. We’re investment consultants for people and we advise them on what investment to make and also how to do that. For instance, if we advise someone on buying a set of 5 stocks, we actually place orders on the market ourselves.

Tell us about the early years of Minance. What inspired your journey in the industry?

I was always interested in finance and investments from a young age. It started in college with just a blog and I wanted to scale up. That’s how Minance was started and slowly, I built a clientele consisting of people looking for opportunities of exploring the market. At Amazon, I got a fair idea of how people thought about their money and finances. I’d speak to my colleagues about how they could diversify their investment and my suggestions worked for them. Our first 300 clients were from Amazon.

There are achievements, perks and successes along the journey of an entrepreneur. Which ones do you count as your biggest successes over the last six years?

The Ministry of Finance in Somalia is also called Minance. Hence, in the initial days, we had a domain issue with them. This shaped into a tiring legal battle but we sailed through with sheer determination and honesty and Minance was finally a reality.

Apart from that, getting a patent in selling unlisted shares of pre-IPO companies was a great deal for us, as it made investing in these unicorn startups as easy as buying something on Amazon. We have made it a ‘click-away’ concept. We proudly call this product ‘Minance Private Market’ wherein we sell stocks of some major players who are yet to hit IPO, and we have made it accessible to everyone.

What is the current Infrastructure at Minance?

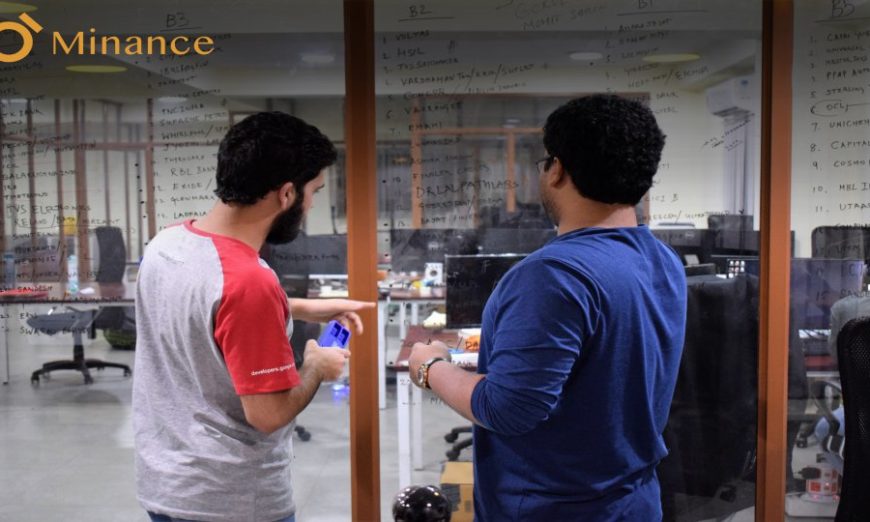

We’re a young team. We’ve taken incredible risks and learnt from successes and failures over time. Therefore, we are constantly looking for things not just in India but in the global scenario. We’ve grown steadily and have about 3000+ happy investors with appx. INR 220 Crore as Assets Under Management (AUM).

What sets us apart is the human connection. Furthermore, our investment operations are completely automated and the service provided is from one person to another. We like to see it as the confluence of Man & Machine.

How did you come to the multi-product model in the wealth management industry?

Having a multi-product lineup is very crucial for a firm like ours because every individual is different. They have different risk appetites and personal preferences when it comes to investing. Therefore, one needs to have a balanced portfolio of products that range from low risk to high risk depending on the market conditions.

Tell us about Minance Private Market.

Minance Private Market is a comprehensive new platform that we have started wherein any person can come and buy unlisted stocks such as Swiggy or PayTM, which haven’t reached the IPO stage yet. Once they reach the IPO, the price of the stock will surge up. Hence it is always better to invest in them right now.

We started with 21 stocks and have scaled up to 89 stocks as of now which will keep expanding. This is a goldmine for young investors as well as for seasoned professionals, and the best part is – it’s like online shopping. I believe this is a gamechanger since we have a process patent that allows only us to be in the e-commerce space for this product.

What advice would you give to the beginners in personal wealth management?

Asset allocation has to be perfect, and that is the key. So, my advice is to have a diverse portfolio to distribute risk and, most importantly have the patience to hold on to investments according to their nature such as mutual funds should be 5 + years, stock for three years or more, have a 15% allocation to fixed income, etc. I lean towards an 8% to 12% allocation to an asset class inversely correlated to equities such as gold. In times of market crashes, gold rises while equities fall. This helps investors to encash on higher gold prices and buy equities cheap.

How had the COVID-19 pandemic affected your industry?

Markets have dropped not only in India but around the globe, which in turn makes it an excellent time for investing not only for the first-timers but also for someone who has been in the game for quite some time. With the right advice, one can multiply their investments and make sure they don’t feel the pressure of stocks diminishing at an alarming rate. That’s’ why we are here!

Also Read: Invest in companies before they launch their IPOs

The post Minance Founder Anurag Bhatia Speaks About Wealth Management appeared first on Digpu News Network.