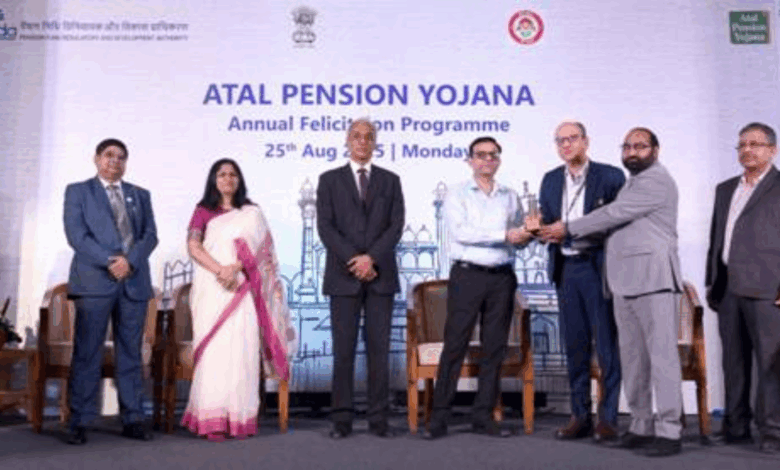

PFRDA Hosts Atal Pension Yojana Annual Felicitation Programme at New Delhi today

With over 8.11 crore enrolments, Atal Pension Yojana marks a decade of success

The Pension Fund Regulatory and Development Authority (PFRDA) organised the APY Annual Felicitation Programme at New Delhi today. In the program, 44 APY SPs, 10 SLBCs and country-wide top five Branches and Lead District Managers were awarded for their outstanding performance in achieving the annual target under APY during the F.Y. 2024-25.

Shri S. Ramann, Chairperson, PFRDA, in his special address, congratulated the winners and urged all stakeholders to continue working with dedication towards building a pensioned society. He recognised the banking fraternity’s crucial support and shared that Atal Pension Yojana, in its 10th year, achieved the fastest-ever 50 lakh subscribers in a single Fiscal Year, with 46% enrolments from youth aged 18–25 years. He underlined that APY, with ₹48,000+ crore AUM and 9.12% CAGR since inception, is a robust and sustainable pension product, and urged all banks, particularly private sector banks, to enhance efforts, improve persistency, and drive financial literacy to achieve pension saturation.

APY has been implemented comprehensively across the country, covering all States and Union Territories. The total gross enrolments under Atal Pension Yojana have crossed 8.11 crore as of 21st August 2025, of which more than 1.17 crore new subscribers were enrolled in F.Y. 2024-25. APY is rapidly gaining popularity amongst the female population and the younger generation of the country. In the FY 2024-25, out of the total enrolments, 55% were women.

In FY 2024-25, the banking fraternity demonstrated outstanding commitment towards APY’s success.

Among Public Sector Banks, Bank of India (126%), State Bank of India (123%), and Indian Bank (118%) led the achievers, followed by Punjab & Sind Bank (106%) and Union Bank of India (103%).

In the Major Private Banks category, IDBI Bank excelled with 145% achievement.

Regional Rural Banks (RRBs) emerged as frontrunners, with Jharkhand Rajya Gramin Bank (393%) and Tripura Gramin Bank (351%) setting benchmarks, alongside strong performances from Punjab Gramin Bank (157%), Andhra Pradesh Grameena Bank (152%), and Assam Gramin Vikash Bank (149%). AU Small Finance Bank also contributed significantly with 109% achievement.

Cooperative Banks also made a mark, led by Shri Mahila Sewa Sahakari Bank (400%), Andhra Pradesh State Co-op Bank (207%), South Canara DCC Bank (142%), Mizoram Co-op Apex Bank (125%), and Sabarkantha DCC Bank (111%).

At the state level, SLBCs such as Jharkhand (184%), Bihar (175%), and Tripura (158%) were top achievers, with West Bengal (148%) and Assam (130%) also performing strongly. At the district level, the Top 5 LDMs were Seoni, Madhya Pradesh (530%), Pakur, Jharkhand (509%), Gaya, Bihar (289%), Maldah, West Bengal (285%), and Murshidabad, West Bengal (268%).

At the branch level, the highest enrolments came from the Mankapur Branch of Indian Bank (5,123), the Sakra Branch of Bank of India (5,050), the Kanti T.P.C. Branch of Bank of India (4,224), the Gauraru Branch of Punjab National Bank (4,200), and the Baragaon Branch of Indian Bank (3,883). Collectively, these achievements reflect the tireless efforts of banks and institutions in expanding APY’s outreach and ensuring pension security for millions.

With APY emerging as a trusted retirement solution for millions, PFRDA reaffirmed its commitment to working closely with banks and post offices to ensure every eligible citizen is covered under the scheme, securing a dignified future for all.

Disclaimer: This is an official press release by Pib.